AI vs. Traditional Dealership Operations: What’s Changing for 2026

-

4 min read

Published Date: January 7, 2026

AI vs. Traditional Dealership Operations: What’s Changing for 2026

81% of dealerships are increasing AI budgets in 2026, driving 10-30% revenue growth.

Traditional dealerships face high costs and declining profits, needing operational improvements.

AI improves lead conversion, boosts sales, and reduces staffing costs.

AI enhances customer engagement, reduces response times by 60%, and increases conversions.

While some dealers worry about AI accuracy, most view it as a job enhancer needing proper training.

The automotive retail landscape is rapidly evolving, and 2026 marks a pivotal year as artificial intelligence (AI) takes a front seat in reshaping dealership operations. Many dealerships continue to wrestle with misconceptions about AI, fearing replacement of human roles or costly disruptions. However, the data tells a different, more promising story: AI is driving tangible efficiency, revenue growth, and customer satisfaction gains. This blog explores the key differences between AI-powered and traditional dealership operations, highlighting what’s changing and why dealerships need to adapt.

Widespread AI adoption in dealerships

Recent industry reports reveal that AI adoption among car dealerships is no longer optional but mainstream. Over 81% of dealerships planned to increase AI budgets in 2025 according to Fullpath, reflecting a growing acknowledgment that AI can boost operational effectiveness significantly. More than half of dealerships using AI reported revenue increases between 10% and 30% in the first half of 2025. These promising stats underscore how AI enhances everything from lead handling to inventory management.

Traditional dealership pain points

Traditional dealership operations face mounting financial pressures. Operating expenses averaged 111% of total gross profit in early 2025, leaving little margin for growth. The same research found gross profit per new vehicle retailed (GPNVR) plummeted by up to 80% year-over-year in several segments, dragging down profitability. With overhead and floorplan costs rising, traditional dealers struggle to maintain financial health without operational improvements.

AI-driven profit and revenue boosts

AI implementation correlates with meaningful revenue uplifts. Dealerships leveraging AI report 10-30% higher sales volumes and markedly faster lead conversions. One dealership documented 47% higher sales than a top competitor through AI-enhanced lead management and chatbot engagement. AI also shortens sales cycles by 33% and reduces staffing costs by around 30%, accelerating operational efficiency.

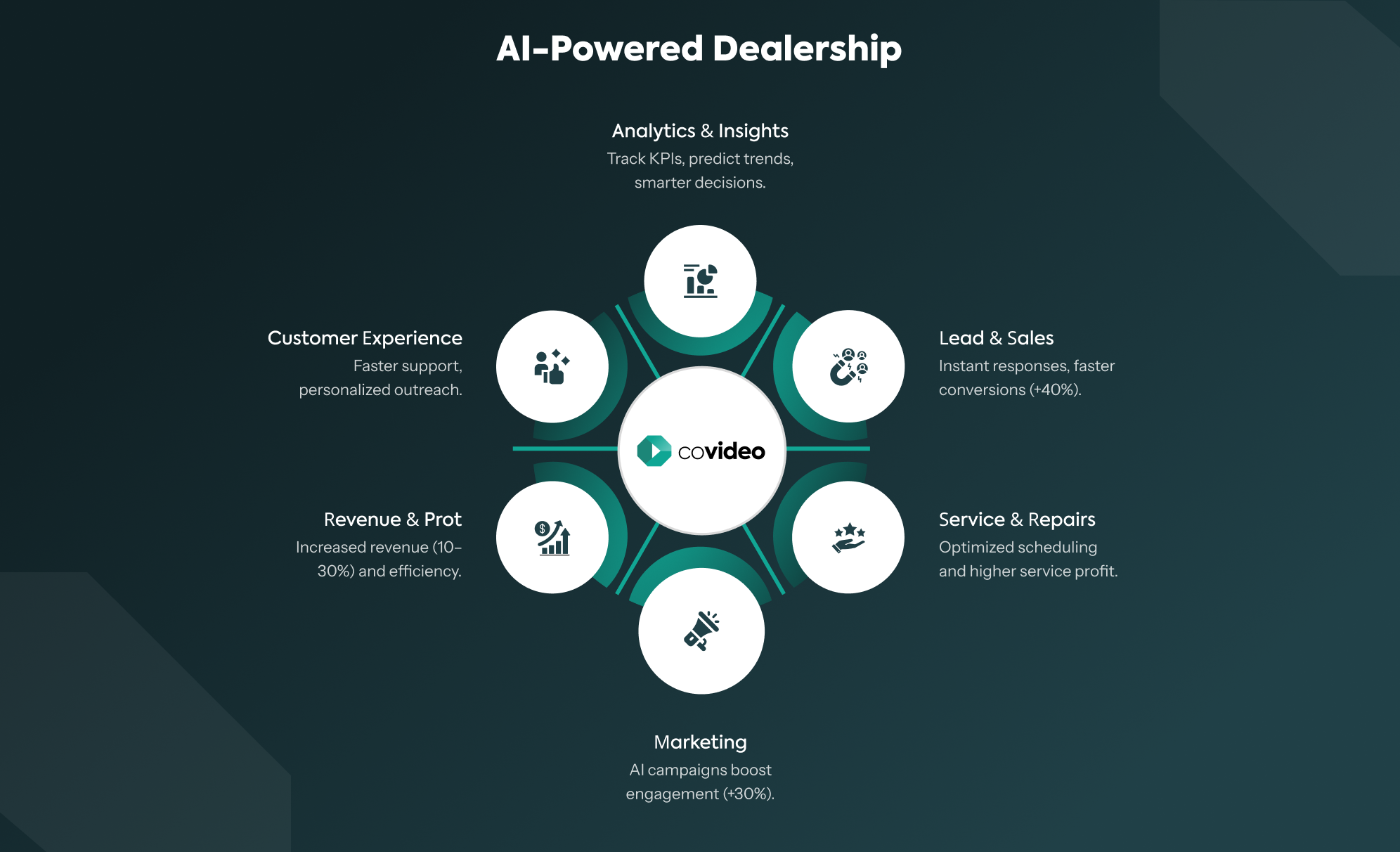

Daily operations: the AI advantage

AI technologies power instant lead responses, automate appointment scheduling, and personalize outreach—boosting lead-to-sale conversion by up to 40%, according to DaveAI. Service departments benefit from higher gross profit per repair order and improved service absorption, now exceeding 68% with AI logistics enhancements.

Customer experience reimagined

From digital campaigns to virtual showrooms, AI elevates the buying experience. Targeted AI campaigns achieve 30% higher engagement than traditional marketing. Dealerships representing top automakers like Ford and GM report customer response times dropped by 60% with AI chatbots. Luxury brands using virtual showrooms, such as BMW and Tesla, have seen significant upticks in online purchase conversion.

Dealer concerns and misconceptions

Despite its benefits, 74% of dealers worry about AI accuracy, and 66% seek better education on AI’s realistic role in operations, according to research from Cox Automotive. Encouragingly, 72% view AI as a job enhancer, not a threat. Closing knowledge gaps and rolling out robust training programs will be critical in 2026.

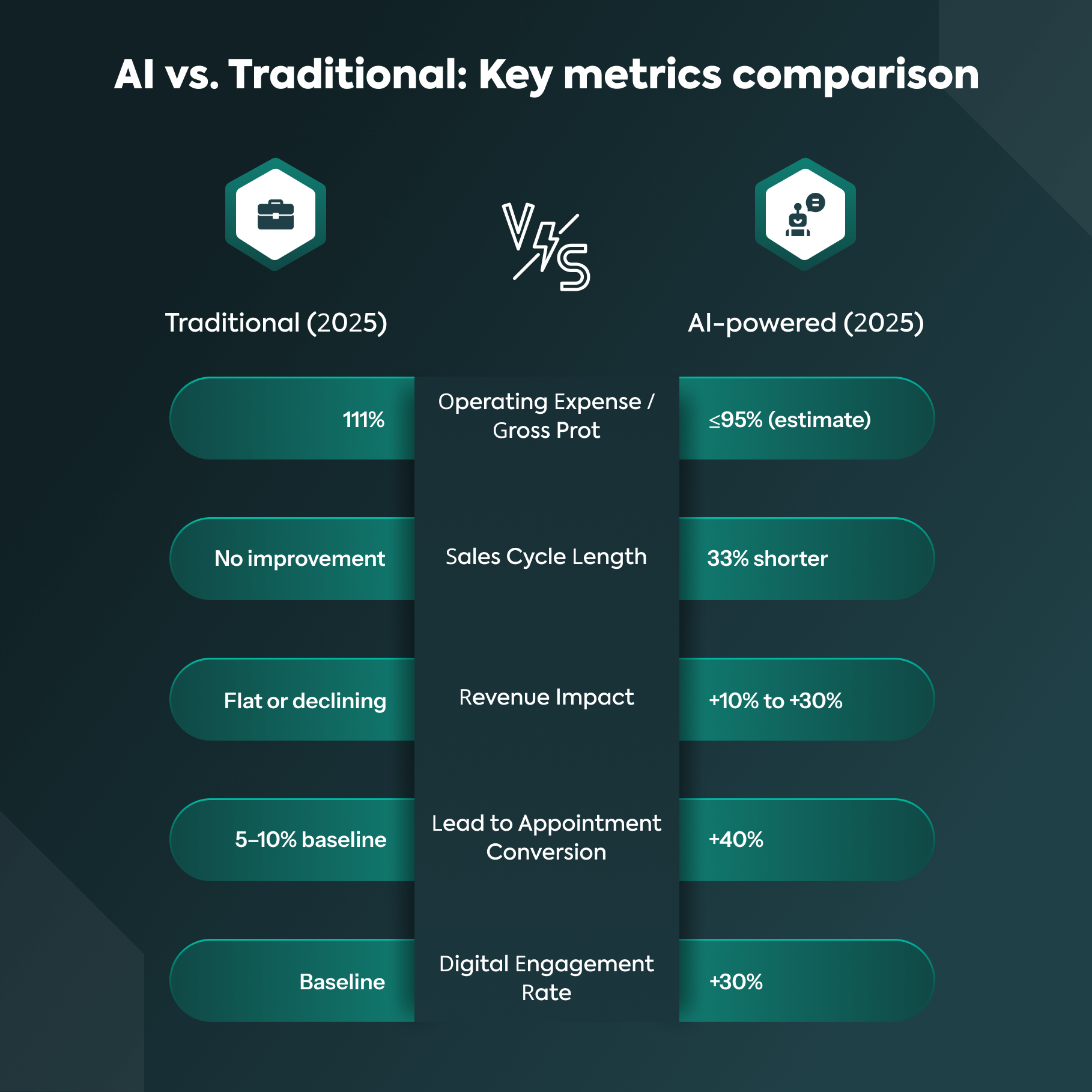

AI vs. Traditional: Key metrics comparison

Metric | Traditional (2025) | AI-powered (2025) |

Operating Expense/Gross Profit | 111% | ≤95% (estimate) |

Sales Cycle Length | No improvement | 33% shorter |

Revenue Impact | Flat or declining | +10% to +30% |

Lead to Appointment Conversion | 5-10% baseline | +40% |

Digital Engagement Rate | Baseline | +30% |

Conclusion:

As 2026 unfolds, AI will transition from emerging technology to indispensable tool in automotive retail. The data clearly shows dealerships integrating AI benefit from significant revenue uplifts, faster sales cycles, and enhanced customer engagement. While traditional dealership models face mounting cost pressures and declining profit margins, AI-driven operations unlock new efficiencies and smarter decision-making—from instant lead responses to inventory optimization.

Dealers who embrace these intelligent tools are better positioned to deliver personalized experiences, anticipate customer needs, and ultimately grow in a fast-evolving marketplace. AI is not merely a technological upgrade—it is the key to sustaining relevance and competitiveness in tomorrow’s automotive retail landscape

Want to learn more about AI tools coming to Covideo? Schedule a demo.